2024 1040 Schedule Dtdc – Depending on the type of activity, you’ll report your crypto gains and losses on Form 1040 Schedule D, or crypto income either on Form 1040 Schedule C for self-employment earnings or Form 1040 . You must file a Form 1040 Schedule A form in order to tally your itemized deductions. Make sure you keep records of those items you deducted in case you’re audited by the IRS. In order for it to .

2024 1040 Schedule Dtdc

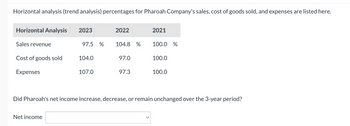

Source : www.amazon.comAnswered: Horizontal analysis (trend analysis)… | bartleby

Source : www.bartleby.comLynn Diamond on LinkedIn: #easa #aircraftmaintenance #england

Source : www.linkedin.comUsed Ford F 350 Trucks for Sale Near Portland, OR | Cars.com

Source : www.cars.comUsed Ford F 350 Trucks for Sale Near Portland, OR | Cars.com

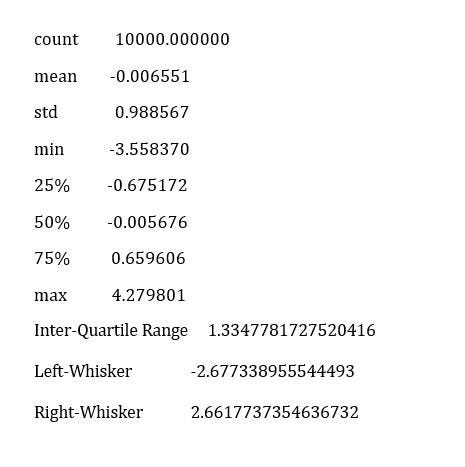

Source : www.cars.comTHE MONOLITH OF DATA. Box and Whisker Plot is a graphical… | by

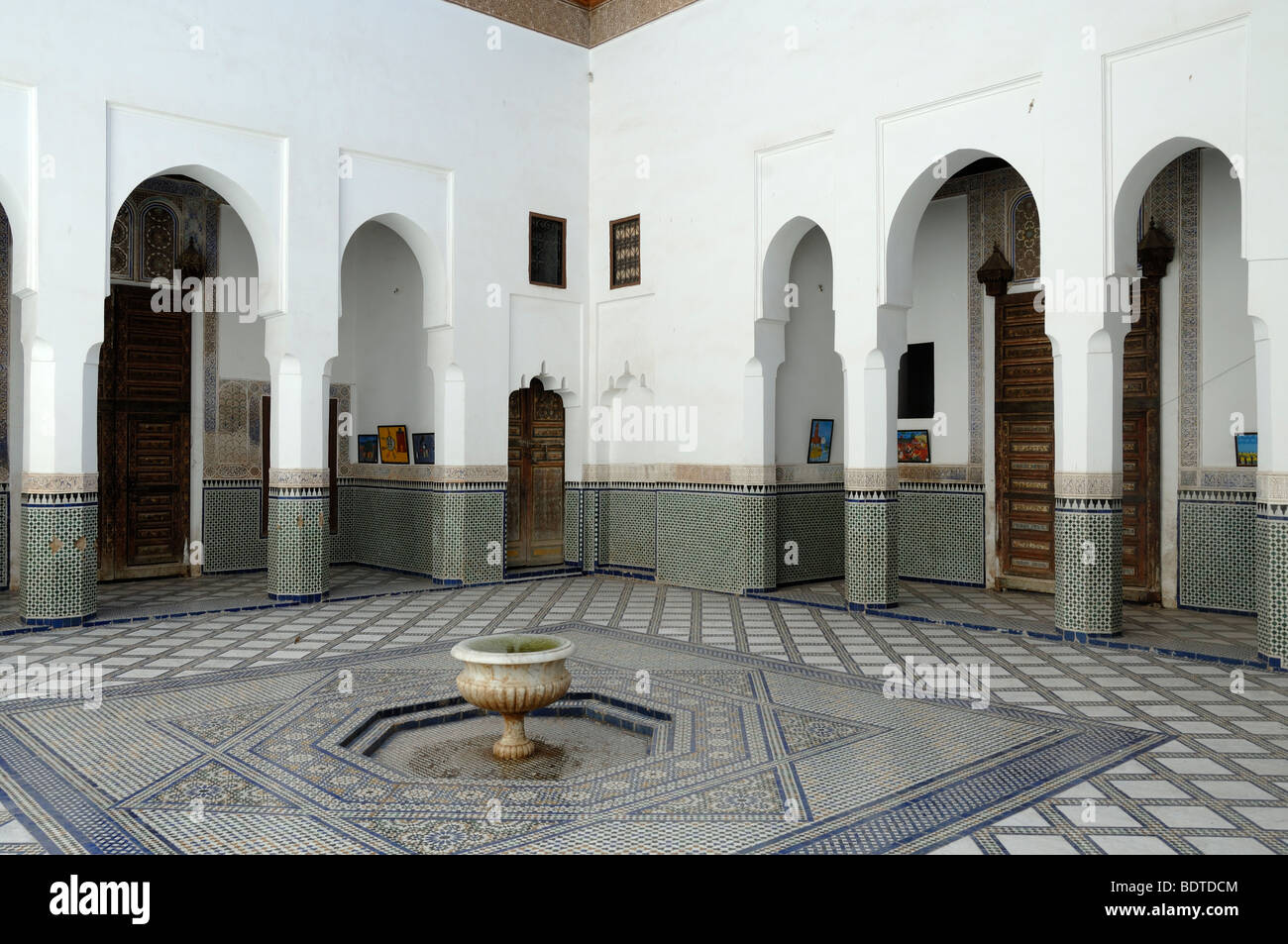

Source : medium.comCourtyard fountain at marrakesh riad hi res stock photography and

Source : www.alamy.comAkash Shaw US Tax Associate || Global Mobility Vialto Partners

Source : in.linkedin.comDHL Express India (@dhlexpressindia) • Instagram photos and videos

Source : www.instagram.comD.R. Brokers | Ambala Cantt

Source : m.facebook.com2024 1040 Schedule Dtdc Amazon.com: Custom Style Personalized Glitter Picture Frames : To take advantage of homeowner tax deductions, you’ll need to itemize your deductions using Form 1040 Schedule A. Your decision to itemize will depend on whether your itemized deductions are . You report commercial sales tax to the IRS on Schedule C, a supplemental sheet of the 1040 group of forms. Form 1040, Schedule C Use Schedule C to report all financial activity from your business. .

]]>