Section 179 Deduction 2024 Vehicle List – Section 179 is a federal rule intended to help small and medium-sized businesses by allowing them to receive specific tax benefits sooner if they choose to do so. If you purchase assets for your . Long ago, in 1958 Congress passed one of its many laws making “technical corrections” to the Internal Revenue Code. Mostly, these are truly technical corrections but there are times when substantive .

Section 179 Deduction 2024 Vehicle List

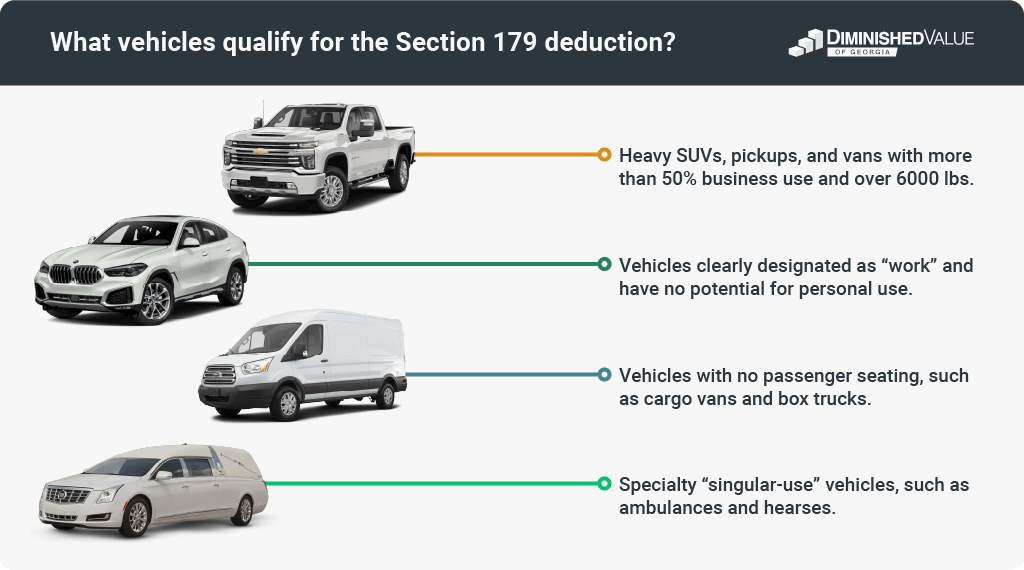

Source : diminishedvalueofgeorgia.comSection 179 Eligible Vehicles at Bob Moore Auto Group

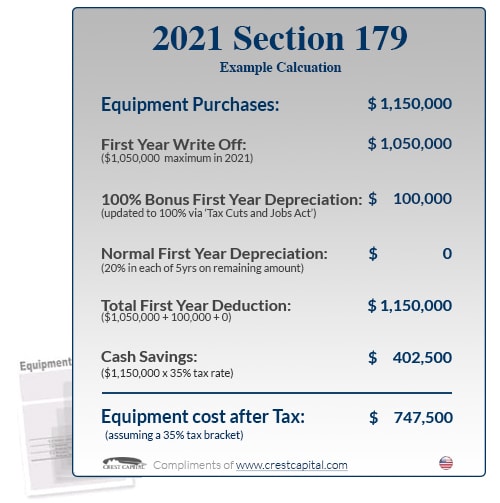

Source : www.bobmoore.comSection 179 & Bonus Depreciation Saving w/ Business Tax Deductions

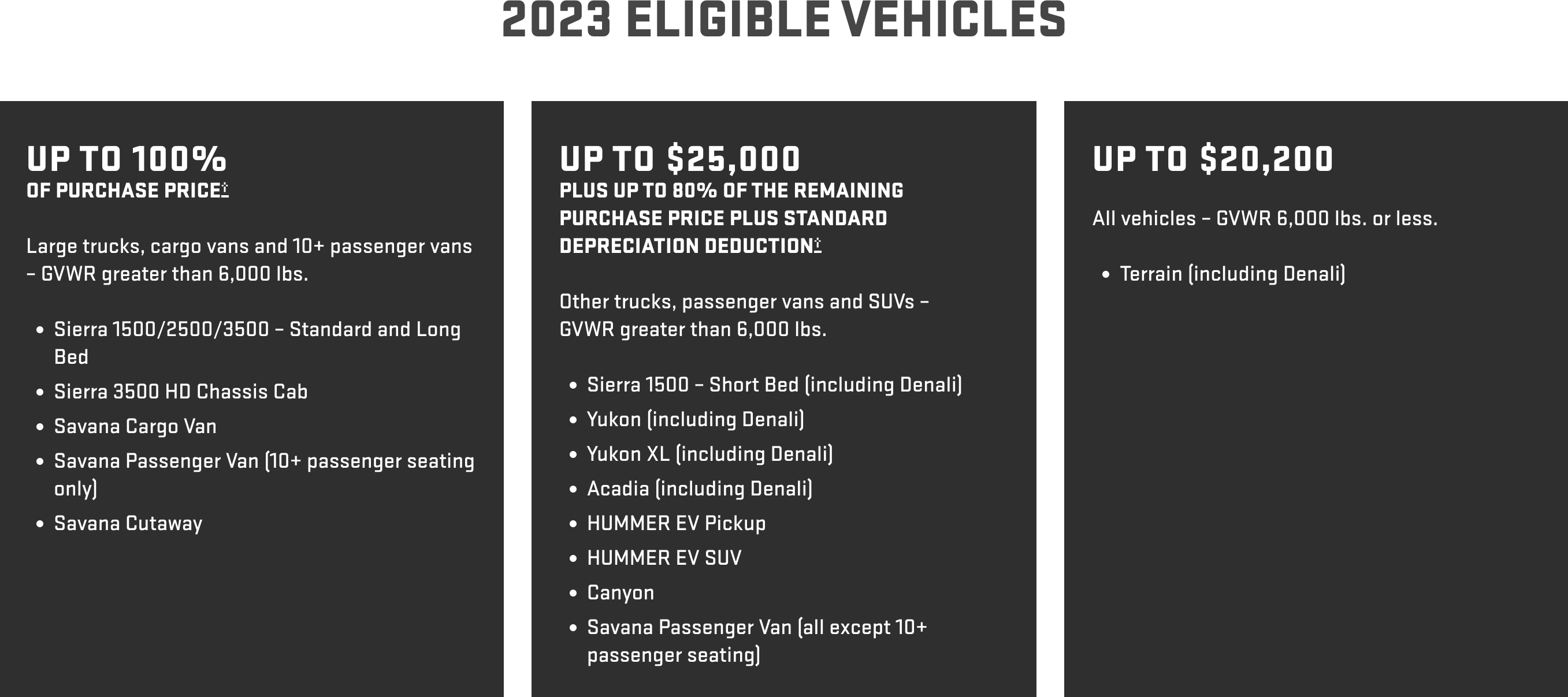

Source : www.commercialcreditgroup.comUnderstanding The Section 179 Deduction Coffman GMC

Source : www.coffmangmc.comSection 179 Deduction List for Vehicles | Block Advisors

Source : www.blockadvisors.comMaserati Section 179 Deduction for Vehicles | Joe Rizza Maserati

Source : www.joerizzamaserati.comSection 179 Deduction Vehicle List 2023 Mercedes Benz of

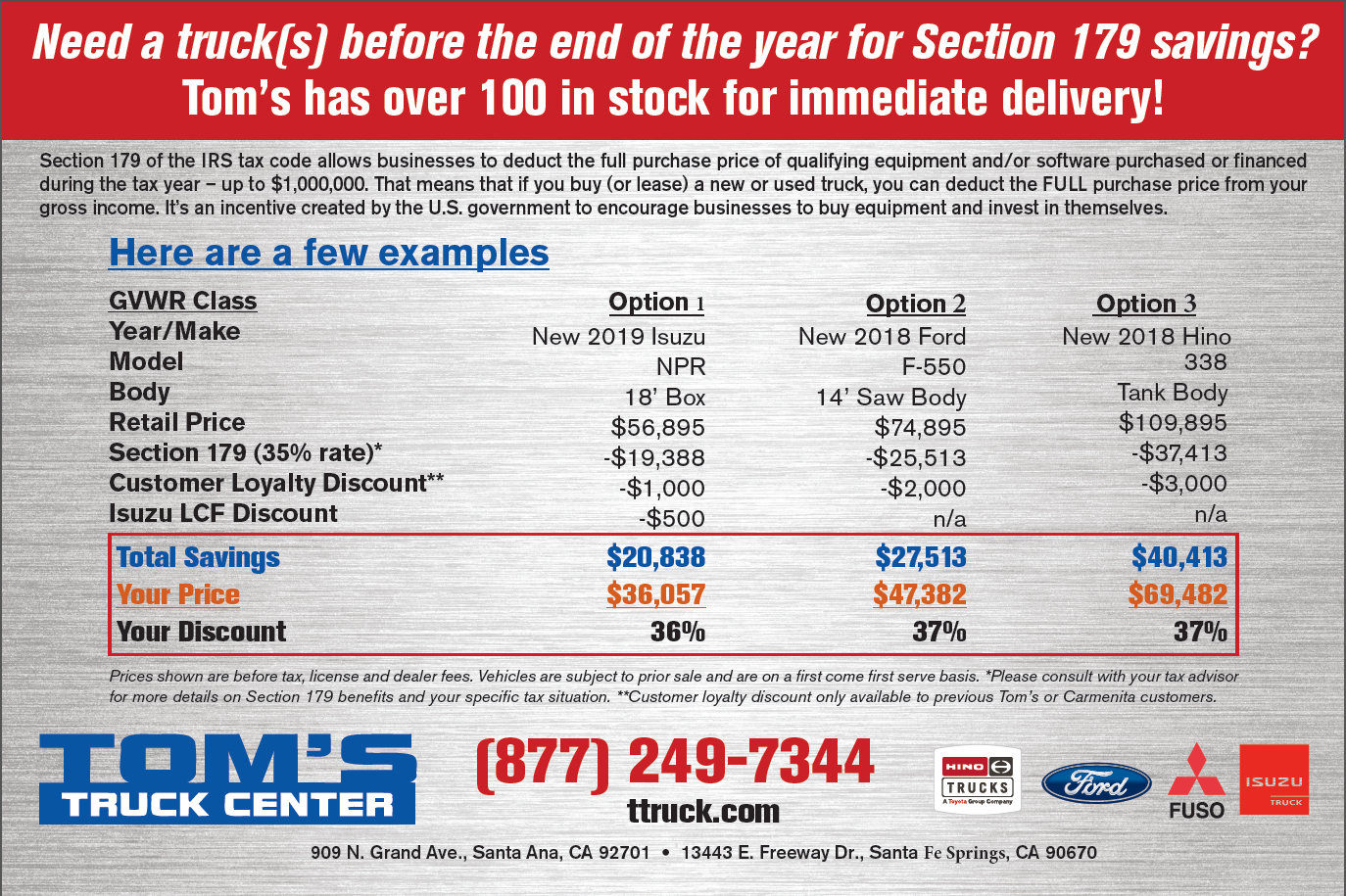

Source : www.mercedesoflittleton.comSection 179 Deductions! | Tom’s Truck Center

Source : www.ttruck.comSection 179 Tax Deduction Vehicles List | Bell Ford

Source : www.bellford.comUpdate] Section 179 Deduction Vehicle List 2024 | XOA TAX

Source : www.xoatax.comSection 179 Deduction 2024 Vehicle List List of Vehicles Over 6000 lbs That Qualify for IRS Tax Benefit in : Necessary expenses are those appropriate for your business, such as gasoline expense for your delivery vehicles You cannot use the Section 179 deduction for inventory you purchase for resale . A bipartisan deal between leaders of the House and Senate tax-writing committees would raise limits on the Section 179 expensing provision that is popular with farmers. The deal also would .

]]>